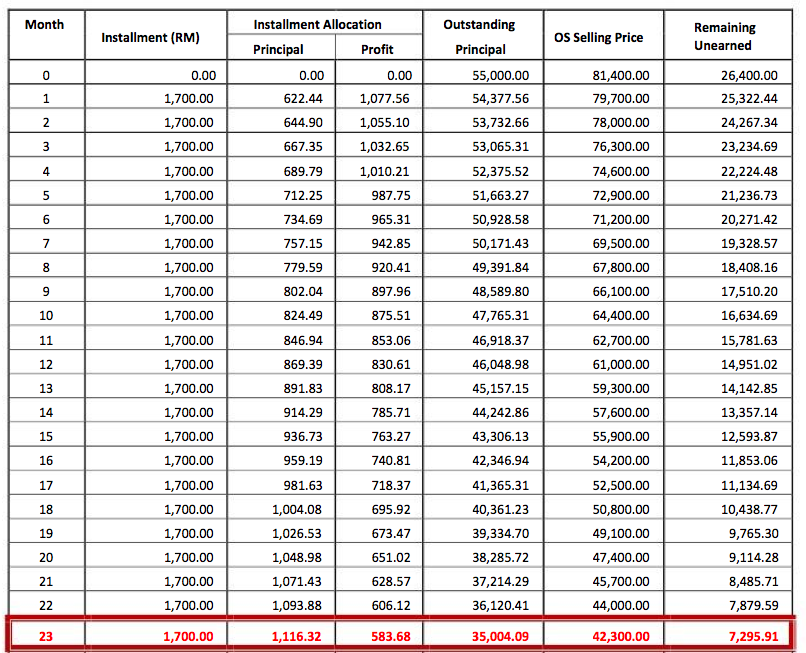

Bank Muamalat Personal Loan Table

Enter loan period in months.

Bank muamalat personal loan table. Which bank has the lowest interest for a personal loan. Untuk semakan kelayakan pinjaman sila call sms whatsapp payslip e penyata gaji ke 0192983056 welcome to personal loan pinjaman peribadi read compare and apply. Bank muamalat personal financing is a shariah and islamic compliant personal loan. Enter loan interest rate in percentage.

Bank personal loan interest rates. Discover tailored plans for non package employees. For the general public alliance bank currently offers the lowest interest rates starting at 5 33 per annum. Government employees can get even lower rates at co op bank pertama which offers profit rates starting at 4 15 per annum.

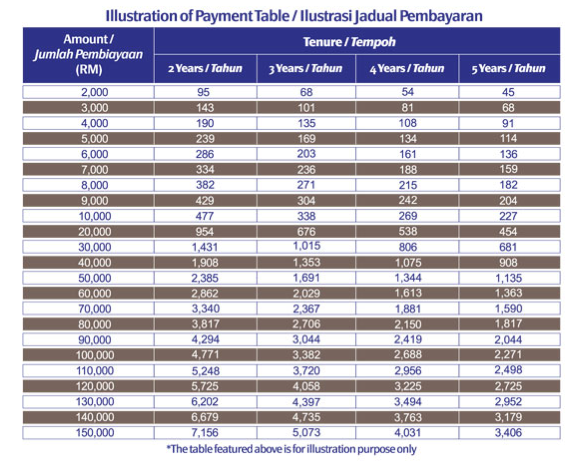

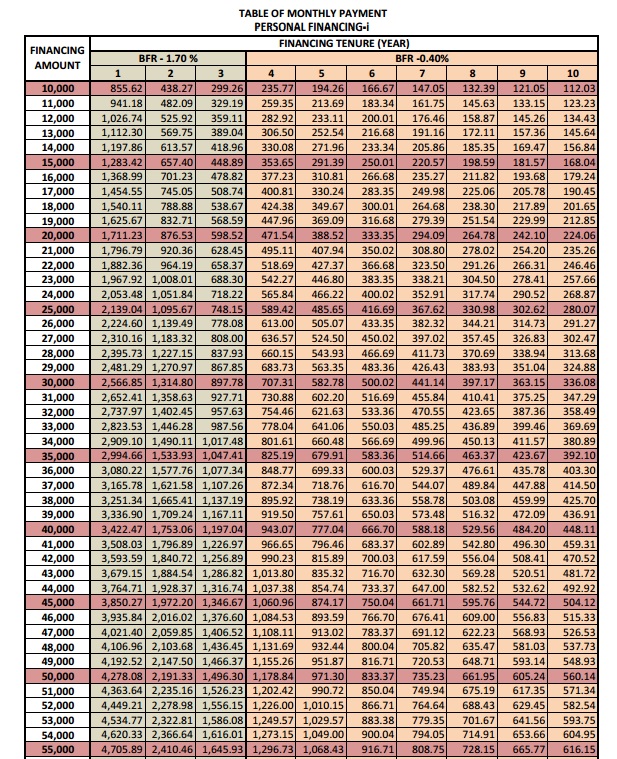

Generally this product is based on tawarruq as its underlying shariah concept for provision of financing. Generate principal interest and balance loan repayment chart over loan period. Untuk semakan kelayakan pinjaman sila call sms whatsapp payslip e penyata gaji ke 0192983056 pinjaman peribadi personal loan personal financing koperasi koperasi loan biro angkasa yayasan yayasan ihsan rakyat. Generate principal interest and balance loan repayment table by year.

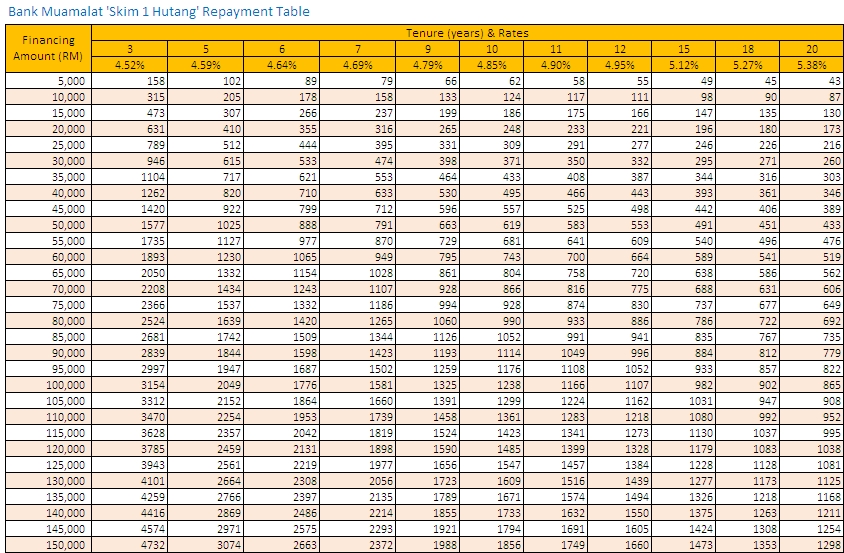

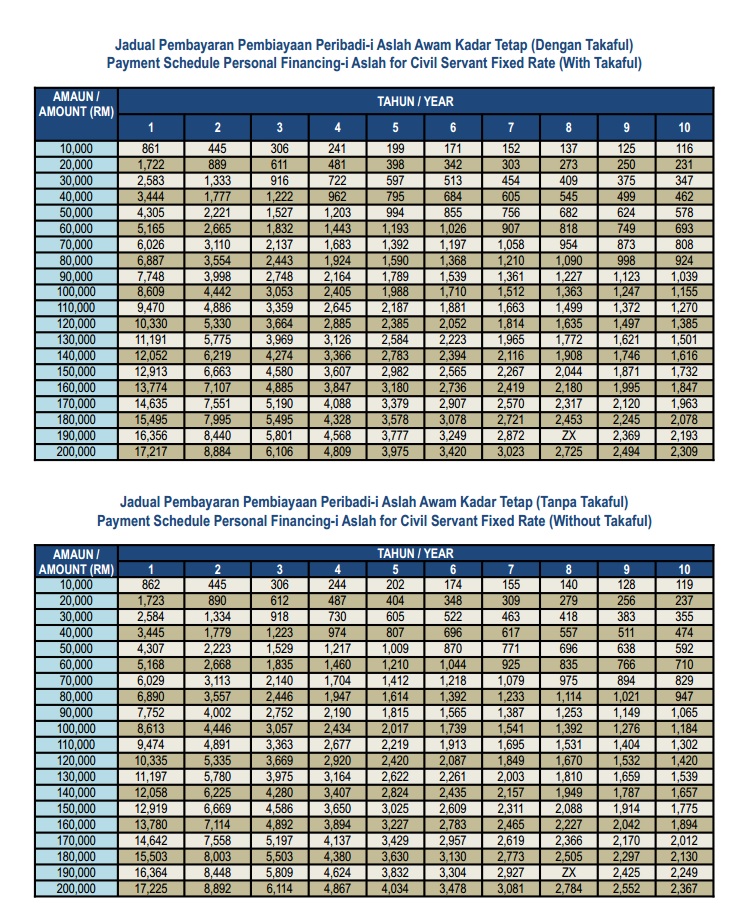

Enter personal loan amount in malaysian ringgit. Indicative effective lending rate for bank muamalat is 3 56 effective from 13 july 2020. Financing for all federal or state government armed forces and government link company tenure minimum of 3 years and maximum of 10 years and financing amount minimum of rm 5 000 00 and maximum of rm 150 000 00 or salary less than 5 000 00. Indicative effective lending rate refers to the indicative annual effective lending rate for a standard 30 year housing loan home financing product with financing amount of rm350k and has no lock in period.

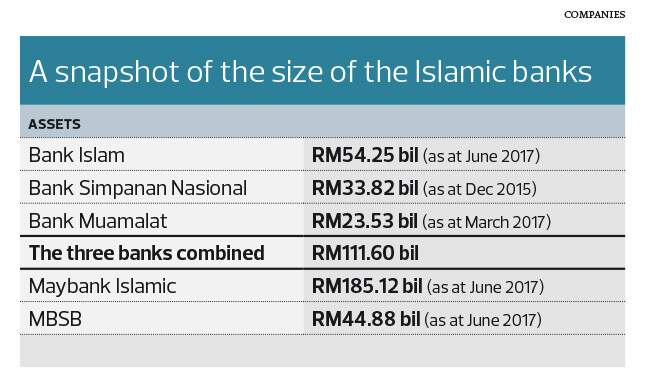

10 times gross salary. Bank muamalat personal loan posted on january 14 2016 by admin bank muamalat personal financing bank muamalat malaysia berhad the second full fledged islamic bank to be established in malaysia after bank islam malaysia berhad is poised to play its role in providing islamic banking products and services to malaysians without regard to race or religious beliefs.